How to Avoid Payroll Issues in Business?

Generally, a small business does not have any payroll team or an accountant. Normally, the people managing payroll at small businesses have a different entire collection of duties like a head of HR, accounting, marketing, or some other set of business-critical responsibilities. Under these circumstances, it is difficult for a business owner to manage all these tasks at a time. So one needs the best payroll software that should automate as much of the payroll method as possible. Keep on reading to know how to avoid payroll issues in business.

Avoid Payroll Issues in Business

Keeping the best tool helps you avoid the common payroll issues that small businesses face, saving much time for your payroll administrator to concentrate on more important tasks.

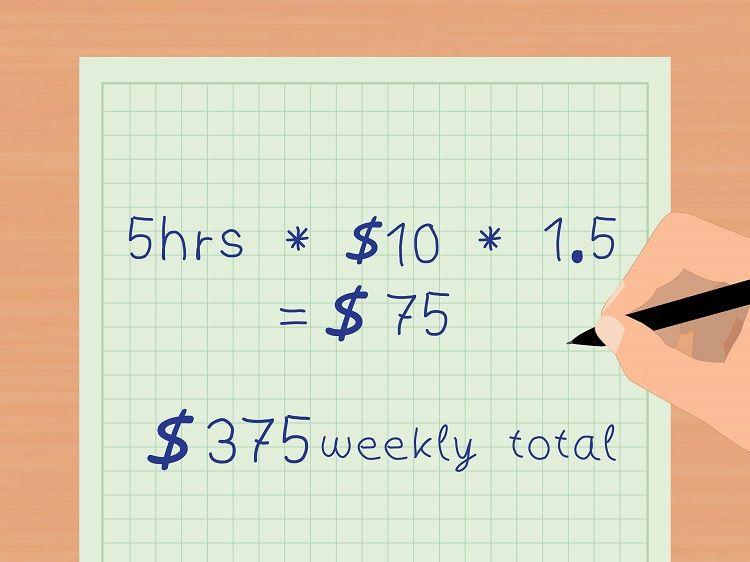

Calculating Overtime

Another important factor that a business owner cannot forget while making payroll is calculating overtime. This is the hours worked. It’s essential to remember that every minute that is given to work or work-related tasks count. Activities that often are being neglected in timesheets are for instance travel time for worksites, coaching, and working before or after actual hours or working from home.

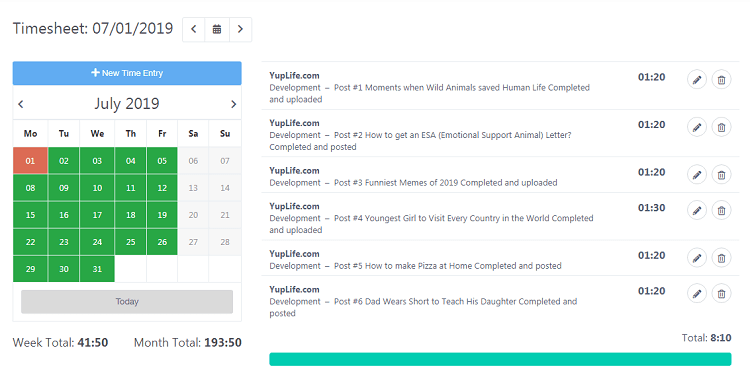

To help you track every second worked, we’ve built a tool that is Timelo. Don't forget to enjoy its amazing features for 15 days for free.

Record Keeping

Every company owner needs to keep the record of all payrolls for at least three years. In some cases even longer.

Though, legal necessities are not the only reason to keep your firms' payroll. The economic data collected in payroll is essential for creating budget estimates for the next years to come.

![]()

One of the most efficient ways to keep your payroll records is to use <a " https:="" timelo.com="" "="">time tracking software or payroll software.

On-time Payroll

Payroll duties can appear disconcerting when you first start a small business. But with small attention and preparation, you can avoid the typical mistakes others make. Planning will determine that staff is paid regularly and on time – always a pleasant outcome. It will also ensure that your payroll reports are up to date and satisfy constitutional rules.

Payroll Tax Code

Tax regulations can change for a wide range of purposes, including wages, perks, bonuses, student loans, past employment, and ranking. Get them wrong and you'll have some expensive recalculations to carry out, not to discuss awkward explanations to the tax officials.

So keep a record of your employees' posts and update all adjustments regularly. Ensure that they’re in the right tax zone.

Accurate Time Tracking

Inaccurate time records result in miscounted work hours. This may produce various payroll issues. The best approach to counter this type of error is to put your faith in a software tool that can track time automatically.

You can do it using Timelo Time tracking software that enables you to automatically track time spent on work. Furthermore, to assist you to ensure every employee follows time accurately.

Security Backup

Cloud-based time tracking software also allows you to invite unlimited users to your business. This implies you don’t need to rely on one person for payday and you’ll be able to encourage most of your staff to manage the payroll. You can also determine the access level of employees to ensure that no one accesses data they shouldn’t be.

Payroll is necessary not only from a business point of view but it directly influences your employees so it's key to the success of your business.